Rebuilding Better – Sustainability after COVID

Summary:

COVID-19 has transformed life around the world. Stay-at-home orders have thankfully slowed the spread of the virus, but as a result, the global economy is in disarray. The COVID-Recession will present significant and, indeed, heartbreaking economic challenges. As of June 1, 2020, one in four American workers have filed for unemployment. At the same time, the climate crisis will not wait—it is real and immediate. Is it possible that we can recommit to our climate goals in a way that addresses this economic emergency and vice versa? Meredith Fowlie of the Energy Institute at Hass (UC Berkeley) has suggested that “[w]e have a moral imperative to rebuild in a way that addresses systemic inequities that the pandemic has laid bare” even as we tackle the existential climate crisis. While addressing economic recovery, social justice and climate change mitigation is a very tall order, Fowlie argues that energy efficiency projects rise to the top of the kinds of investments that can address these three challenges simultaneously. This paper reviews strategies business leaders can use to capitalize on this transformative era and leverage new business models to meet climate goals, bring employees back, help rebuild a greater economy and better prepare for the future.

Background:

By May of 2020, the pandemic’s economic pause resulted in cleaner air and clearer water, but the long-term economic response to COVID-19 could push emissions in the wrong direction. Stay-at-home orders have produced significant improvements to the environment. The question is whether these changes will be short-lived or whether organizations take this opportunity to shape their corporate goals to include more aggressive climate action.

Whether sustainability has been just one item on your strategic plan or the core of your organization’s ethos, now more than ever energy efficiency and clean generation projects are smart business decisions. Regardless of where your organization stands on the issue, moving forward with efficiency projects are an attractive choice as they reduce operational expenses and mitigate risk– benefitting organizations on multiple fronts. As the global economy reopens, firms that implement energy efficiency projects can free up working capital to rehire employees and get back to full speed more quickly. Furthermore, acting on these projects now can make your organization part of the solution to the climate crisis

There is mounting evidence that our society is running out of time to lower emissions and curb climate disasters. According to the United Nations Fourth Assessment on the Intergovernmental Panel on Climate Change IPCC report, we have ten years to limit carbon emissions to keep global warming below 1.5°C above pre-industrial levels or we risk severe impacts of climate change on society. Achieving this goal requires a 60% reduction of emissions from 2018 levels. We need solutions now. The time to consider when to act has passed; it is time to make significant changes to how buildings operate, how we harvest our energy savings, how we create value for organizations and, most importantly, how we deliver carbon savings.

Strategies to help your businesses expand and achieve climate goals and accelerate job creation and hiring in a post-COVID-19 world include:

- Update and renew your sustainability commitments

- New capital and budgeting strategies

Sustainability Commitments:

In the decade following the great recession, sustainability rose in importance to the American consumer and the investment community. Organizations noticed and acted; according to the Governance & Accountability Institute, in 2011, only 20% of the S&P 500 reported on sustainability; in 2019, 86% reported on such metrics. In the immediate aftermath of COVID-19, sustainability and climate goals may take a back seat, but as long-term recovery commences, sustainability goals cannot be forgotten. The planet does not have another decade to waste if we want to avoid significant damage from climate change. COVID-19 has proven that listening to the scientific community and responding to such invisible threats with seriousness and speed are the only ways to avoid catastrophe. Furthermore, as time goes by, consumers and the public may not accept delay in achieving corporate goals that were set before the pandemic.

So-the time is right to understand sustainability goals and to recommit to them or even increase them in the post-COVID world.

To understand these goals, it is important to understand that the climate science community has divided emissions into three categories (“Scopes”) and that sustainability goals are understood to be more aggressive and more serious as the move from Scope 1 to Scope 3.

Scope 1: All Direct Emissions from activities under an organization owned or controlled sources.

Scope 2: Indirect Emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the company.

Scope 3: All other Indirect Emissions from activities that the organization neither controls nor owns.

Substantial gains not thought possible in the pre-COVID-19 world are now on the table because of the transformation wrought by stay-at-home orders. In the post COVID economy, organizations may be expected to expand their ambitions to include all three scopes. Furthermore, the adaptations required by stay-at-home orders have identified new tactics for reducing emissions for each Scope. Specifically, such changes might include:

Scope 1: Reevaluate physical office space needs. A telecommuting workforce would reduce the amount of office space needed.

Scope 2: Less office space reduces the indirect emissions from these sites. The remaining assets should be improved to use the least amount of energy possible.

Scope 3: Telecommuting will provide significant reductions in employee commuting and leased office space requirements. Teleworking will also significantly reduce business travel.

From WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard, page 5.

Capital and Budgeting Strategy:

Any organization re-evaluating its sustainability goals must also think about capital budgeting strategies and limitations.

Increasing energy efficiency and reducing emissions inevitable includes capital expenditures. Executives make the best decisions they can based on the organization’s value system. It is common for a healthcare executive to ask, “Why should I invest my million dollars in sustainable lighting/solar/HVAC/etc. when I can purchase a new MRI machine for the same amount, which I know will be a better investment for our property?”

Whether it is an MRI machine, a freezer, or a new manufacturing line, the capital budget for any organization will always include line items that will have a better return on investments, better understood by management and have a more direct relationship with revenue than an energy project. This does not make cleantech a bad investment, but since the value may not translate directly to an organization’s short-term goals, the following alternatives may be more attractive.

Alternative #1: Traditional Financing

Energy efficiency projects have a payback calculation that is easy to grasp. Total energy savings per year (for instance, $50,000) divided by total capital cost (let us say $150,000) equals years to return on capital (in this case, 3 years). Many companies use this simple formula and create a finance package that delivers them an immediate operational expense reduction ($150,000 financed for 6 years, for example). Traditional commercial financing often requires a down payment, which could prevent the project from being cash flow positive Traditional financing is a simple alternative to capital budgeting; however, debt financing secures or looks for a guarantee on the capital the lender provides. If the energy savings estimates do not materialize as projected, the project can increase operational expenses; additionally, debt is subject to the balance sheet and can affect important lending ratios that could limit additional debt in the future.

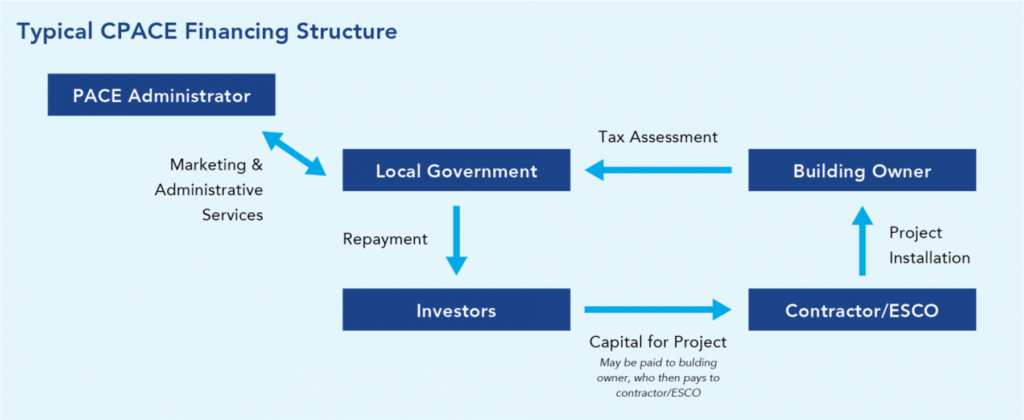

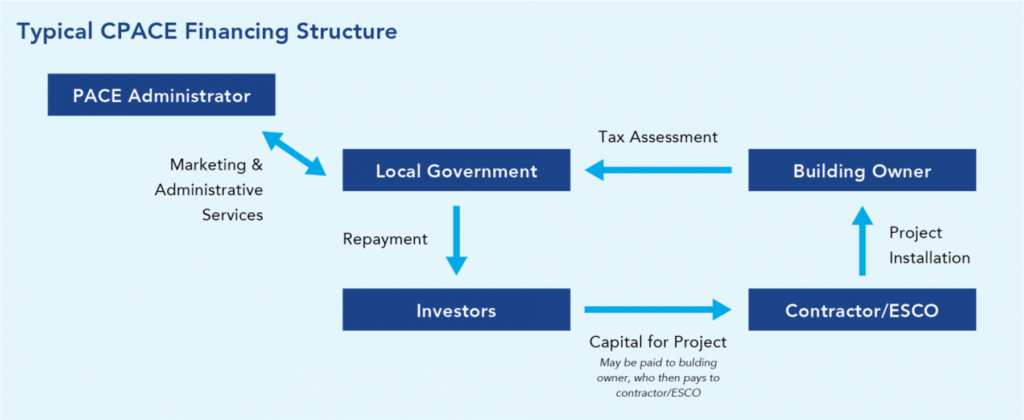

Alternative #2: CPACE

A new lending mechanism that looks to solve the issue of debt on the balance sheet is Commercial Property Assessed Clean Energy, or CPACE, a lending solution that ties the capital investment to the property and not to the owner of the property. The property then makes payments to their lender through property tax payments. CPACE provides off-balance sheet treatment because it is made directly to the local municipality. CPACE allows property owners to invest in their facilities without the worry of moving in 5, 10, or even 15 years. The assessment will stay with the property and not with the owner of the facility.

From <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/cpace>

Typically, each municipality must approve CPACE, and each state must pass legislation to allow Municipalities to do so. As of 2020, CPACE has been approved in over 20 states, adoption is growing every year, so jurisdictional limitations should become less of an issue over time.

Besides jurisdictional limits, the other main issue with CPACE has been the primary lien position requirement. Properties looking to use CPACE that have mortgages must have a lender willing to relinquish the prime position on the mortgage. CPACE requires a primary position on the property; however, one workaround is to use the same lending institution that owns the mortgage to back the CPACE agreement. In a world of mortgage-backed securities, finding mortgage holders can prove difficult, and receiving approval to accept a second position may just be as difficult.

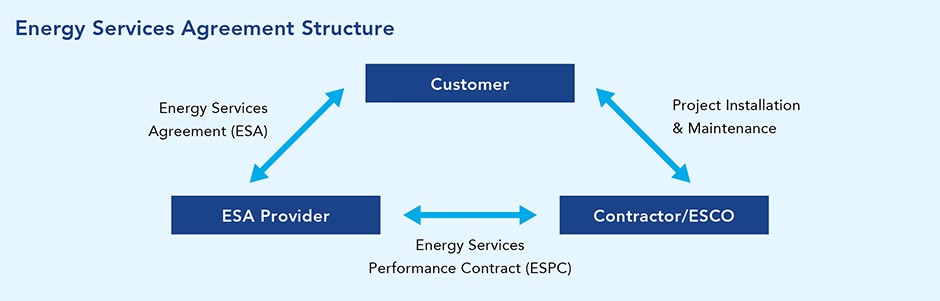

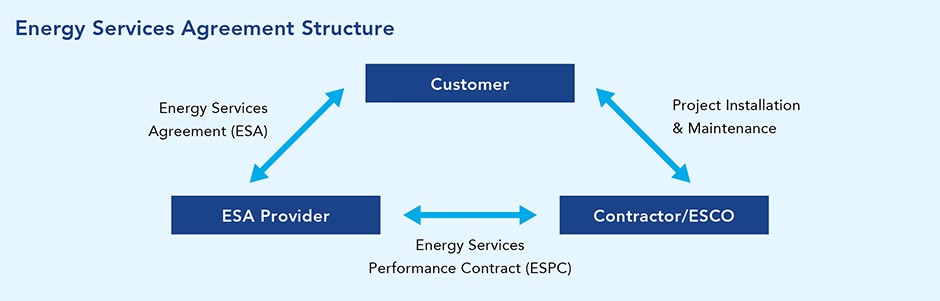

Alternative #3: Energy Service Agreements

The latest evolution in funding mechanisms is the Energy Service Agreement or Energy As A Service, which solves the issues of debt and performance risk. It has no jurisdictional limits, nor does it take a position on the property. RENEW Energy Partners Energy Service Agreement helps building owners reduce their carbon footprint and save money by making commercial and industrial buildings cleaner, more energy-efficient, and more resilient. RENEW Energy Partners finances, installs, and manages systems for energy-efficiency and on-site power generation at no cost to the building owner.

The upgrades are funded by future savings. RENEW Energy Partners provides the upfront capital and expertise to purchase, install, and maintain new systems under an Energy Service Agreement. Monthly, for the duration of the agreement (typically 5 to 10 years), a portion of the savings is paid to RENEW Energy Partners, and a portion goes to the building owner. After the term of the agreement, 100% of the savings go to the building owner, and the new system becomes their property.

From <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/efficiency-a-service>

The RENEW Energy Service agreement is particularly beneficial for owners of multiple properties. In the Energy Service Agreement, the property owner can have work completed across the United States and only pay for savings as they are measured and verified. This off-balance sheet solution allows capital projects to get done sooner and no longer compete with other business projects that can only be purchased directly.

Conclusion

Government, Institutions, and Businesses must rebuild better. If COVID has shown society nothing else, trusting science can lead to favorable results, and society can handle extreme changes to daily life. While Governments and Institutions are implementing plans for reopening, Businesses must meet this opportunity as well.

Pre-COVID RENEW Energy Partners was proud that all team members took public transportation to our main office. Proud that we traveled almost exclusively by train for our interstate travel. Proud of the work we do every day in delivering carbon savings as a service. A new normal at RENEW will mean more telecommuting, virtual meetings, and even virtual energy audits. As a service company, our scope one emissions have always been low, and we are now able to reduce them further and reduce our scope three emissions significantly.

A new normal is more than a digital transformation. From companies large to small, it is an opportunity to test novel business strategies and meet new and unexpected customer needs. RENEW Energy Partners looks forward to seeing these ideas, companies, and products created to meet this moment. RENEW looks ahead to a more sustainable future.

To reach aggressive decarbonization goals at state and municipal levels, fossil fuel combustion must be replaced in part through electrification of buildings. What this means is substituting space and water heating/cooling fossil fuel technologies with electric technologies. The interest in electrification is a trending topic in energy efficiency and decarbonization at the commercial, industrial, and residential levels, and a primary component of the Green New Deal.

To reach aggressive decarbonization goals at state and municipal levels, fossil fuel combustion must be replaced in part through electrification of buildings. What this means is substituting space and water heating/cooling fossil fuel technologies with electric technologies. The interest in electrification is a trending topic in energy efficiency and decarbonization at the commercial, industrial, and residential levels, and a primary component of the Green New Deal.